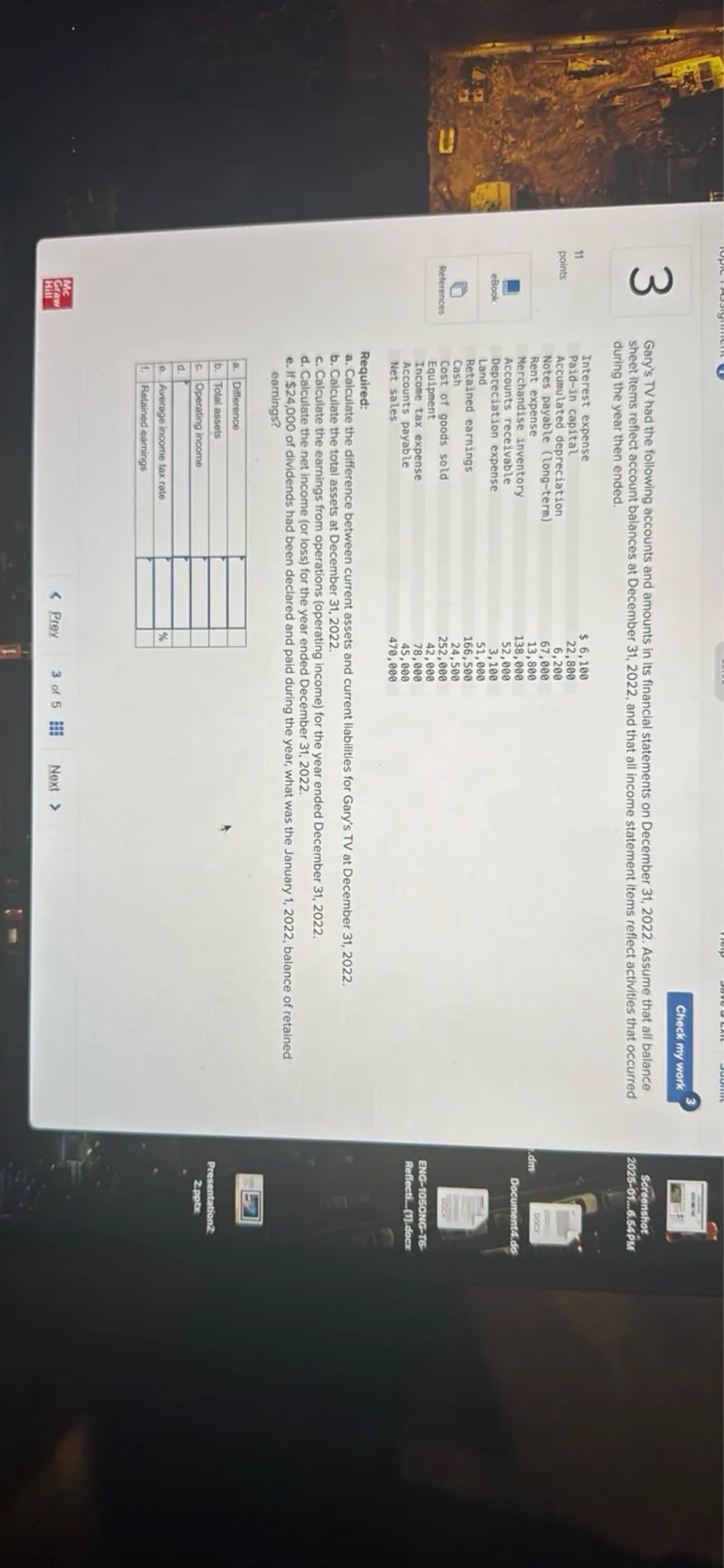

Questions: Reconcile the difference between gross and current liabilities of Gary's TV Decorating 31, 2022. Required: this difference between current liabilities on Gary's TV Decorating balance sheet at December 31, 2022, and the year end balances of the accounts payable and notes payable accounts at December 31, 2022, below: a. Calculate the net income (loss) for the year ended December 31, 2022 b. Calculate the net increase (decrease) in cash for the year ended December 31, 2022 c. Calculate the total current liabilities at December 31, 2022 d. Calculate the total owner's equity at December 31, 2022 e. Prepare the statement of owner's equity for the year ended

Transcript text: Reconcile the difference between gross and current liabilities of Gary's TV & Decorating 31, 2022.

Required: this difference between current liabilities on Gary's TV & Decorating balance sheet at December 31, 2022, and the year end balances of the accounts payable and notes payable accounts at December 31, 2022, below:

a. Calculate the net income (loss) for the year ended December 31, 2022

b. Calculate the net increase (decrease) in cash for the year ended December 31, 2022

c. Calculate the total current liabilities at December 31, 2022

d. Calculate the total owner's equity at December 31, 2022

e. Prepare the statement of owner's equity for the year ended