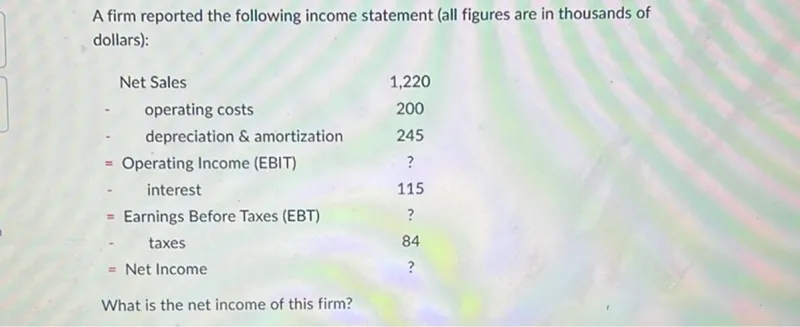

Questions: A firm reported the following income statement (all figures are in thousands of dollars): Net Sales 1,220 - operating costs 200 - depreciation amortization 245 = Operating Income (EBIT) ? - interest 115 = Earnings Before Taxes (EBT) ? - taxes 84 = Net Income ? What is the net income of this firm?

Transcript text: A firm reported the following income statement (all figures are in thousands of dollars):

\begin{tabular}{lc}

Net Sales & 1,220 \\

- operating costs & 200 \\

- depreciation \& amortization & 245 \\

$=$ Operating Income (EBIT) & $?$ \\

- interest & 115 \\

$=$ Earnings Before Taxes (EBT) & $?$ \\

- taxes & 84 \\

$=$ Net Income & $?$

\end{tabular}

What is the net income of this firm?