Questions: Cheryl Carver works at College of Fresno and is paid 30 per hour for a 40-hour workweek and time-and-a-half for hours above 40. Requirement 1. Compute Carver's gross pay for working 46 hours during the first week of February. Straight-time pay for 40 hours: 1,200.00 Overtime pay for 6 hours: 270.00 Gross Pay: 1,470.00 Requirement 2. Carver is single, and her income tax withholding is 20% of total pay. Carver's only payroll deductions are payroll taxes. Compute Carver's net (take-home) pay for the week. Assume Carver's earnings to date are less than the OASDI limit. (Round all amounts to the nearest cent.) Gross pay 1,470.00 Withholding deductions: Employee OASDI tax: 91.14 Employee income tax: 294.00 Total withholdings: Net (take-home) pay: For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first 132,900 earned; Medicare: 1.45% up to 200,000, 2.35% on earnings above 200,000. Employer: OASDI: 6.2% on first 132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first 7,000 earned; SUTA: 5.4% on first 7,000 earned.

Transcript text: Cheryl Carver works at College of Fresno and is paid $\$ 30$ per hour for a 40 -hour workweek and time-and-a-half for hours above 40.

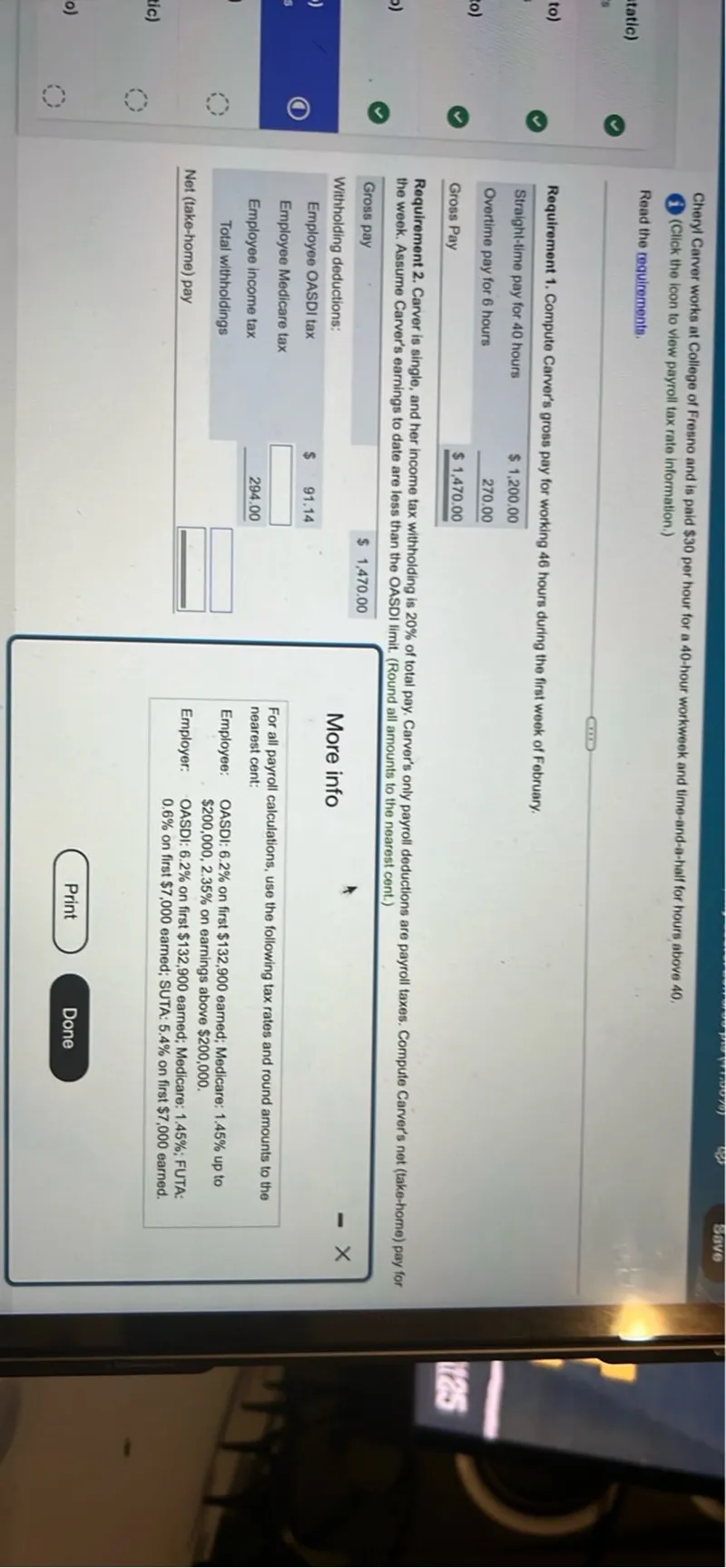

Requirement 1. Compute Carver's gross pay for working 46 hours during the first week of February.

\begin{tabular}{lr}

\hline Straight-time pay for 40 hours & $\$ 1,200.00$ \\

Overtime pay for 6 hours & 270.00 \\

\cline { 2 - 2 } Gross Pay & $\$ 1,470.00$ \\

\hline

\end{tabular}

Requirement 2. Carver is single, and her income tax withholding is 20\% of total pay. Carver's only payroll deductions are payroll taxes. Compute Carver's net (take-home) pay for the week. Assume Carver's earnings to date are less than the OASDI limit. (Round all amounts to the nearest cent.)

Gross pay

\$ $1,470.00$

Withholding deductions:

\begin{tabular}{l|r|}

\hline Employee OASDI tax & $\$ 91.14$ \\

Employee Medicare tax & $\square$ \\

Employee income tax & 294.00 \\

\hline Total withholdings & $\square$ \\

\hline Net (take-home) pay & $\square$ \\

\hline

\end{tabular}

For all payroll calculations, use the following tax rates and round amounts to the nearest cent:

Employee: OASDI: $6.2 \%$ on first $\$ 132,900$ earned; Medicare: $1.45 \%$ up to $\$ 200,000,2.35 \%$ on earnings above $\$ 200,000$.

Employer: OASDI: $6.2 \%$ on first $\$ 132,900$ earned; Medicare: $1.45 \%$; FUTA: $0.6 \%$ on first $\$ 7,000$ earned; SUTA: $5.4 \%$ on first $\$ 7,000$ earned.