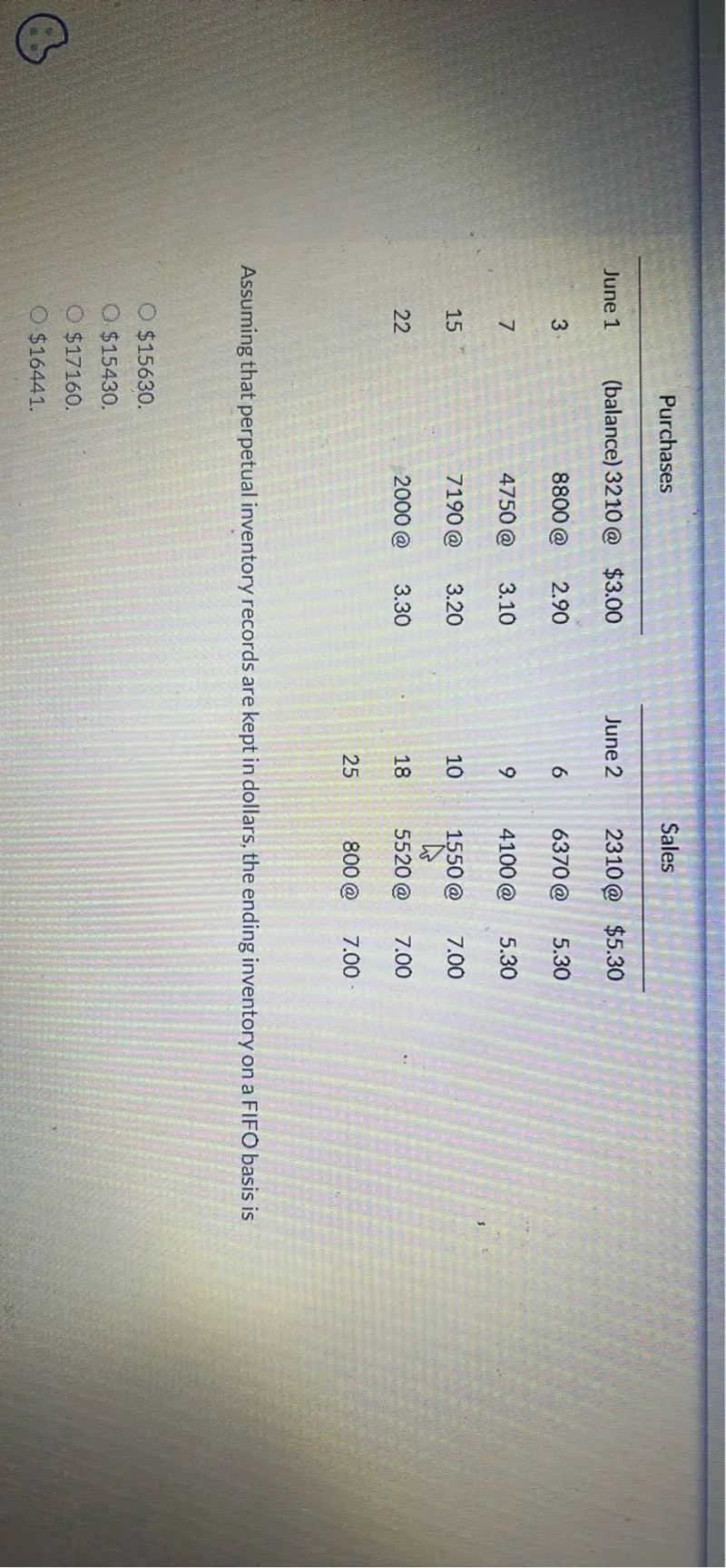

Questions: June 1 (balance) 3210 3.00 June 2 2310 5.30 3 8800 2.90 6 6370 5.30 7 4750 3.10 9 4100 5.30 15 7190 3.20 10 1550 7.00 22 2000 3.30 18 5520 7.00 25 800 7.00 Assuming that perpetual inventory records are kept in dollars, the ending inventory on a FIFO basis is 15630, 15430, 17160, 16441.

Transcript text: \begin{tabular}{|c|c|c|c|c|c|}

\hline June 1 & (balance) 3210@ & \$3.00 & June 2 & 2310@ & \$5.30 \\

\hline 3 & 8800 @ & 2.90 & 6 & 6370@ & 5.30 \\

\hline 7 & 4750 @ & 3.10 & 9 & 4100 @ & 5.30 \\

\hline 15 & 7190 @ & 3.20 & 10 & 1550@ & 7.00 \\

\hline 22 & 2000 @ & 3.30 & 18 & 5520 @ & 7.00 \\

\hline & & & 25 & 800 @ & 7.00 \\

\hline

\end{tabular}

Assuming that perpetual inventory records are kept in dollars, the ending inventory on a FIFO basis is

\$15630.

\$15430.

\$17160.

$\$ 16441$.