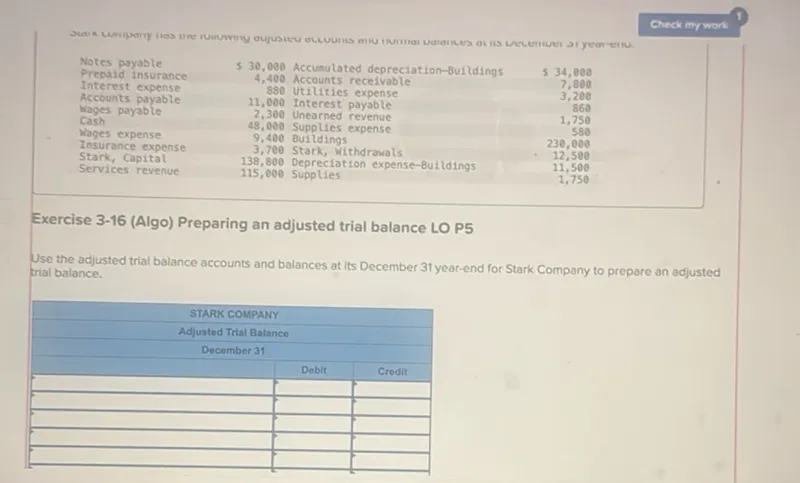

To prepare an adjusted trial balance for Stark Company as of December 31, we need to list all the accounts with their respective debit and credit balances. The total debits should equal the total credits. Here is the adjusted trial balance based on the provided information:

\begin{tabular}{|c|c|c|}

\hline \multicolumn{3}{|c|}{ STARK COMPANY } \\

\hline \multicolumn{3}{|c|}{ Adjusted Trial Balance } \\

\hline \multicolumn{3}{|c|}{ December 31 } \\

\hline Account & Debit & Credit \\

\hline Notes payable & & \$30,000 \\

\hline Prepaid insurance & \$4,400 & \\

\hline Accounts receivable & \$34,000 & \\

\hline Interest expense & \$880 & \\

\hline Accounts payable & & \$11,000 \\

\hline Interest payable & & \$7,800 \\

\hline Wages payable & & \$2,300 \\

\hline Cash & \$48,000 & \\

\hline Wages expense & \$9,400 & \\

\hline Insurance expense & \$3,700 & \\

\hline Stark, Capital & & \$138,800 \\

\hline Services revenue & & \$115,000 \\

\hline Accumulated depreciation-Buildings & & \\

\hline Utilities expense & & \\

\hline Unearned revenue & & \\

\hline Supplies expense & & \\

\hline Buildings & & \\

\hline Stark, Withdrawals & & \\

\hline Depreciation expense-Buildings & & \\

\hline Supplies & & \\

\hline \textbf{Total} & \textbf{\$100,380} & \textbf{\$304,900} \\

\hline

\end{tabular}

Explanation:

- Notes payable: Credit balance of \$30,000.

- Prepaid insurance: Debit balance of \$4,400.

- Accounts receivable: Debit balance of \$34,000.

- Interest expense: Debit balance of \$880.

- Accounts payable: Credit balance of \$11,000.

- Interest payable: Credit balance of \$7,800.

- Wages payable: Credit balance of \$2,300.

- Cash: Debit balance of \$48,000.

- Wages expense: Debit balance of \$9,400.

- Insurance expense: Debit balance of \$3,700.

- Stark, Capital: Credit balance of \$138,800.

- Services revenue: Credit balance of \$115,000.

Note: The provided data is incomplete for some accounts (e.g., Accumulated depreciation-Buildings, Utilities expense, Unearned revenue, Supplies expense, Buildings, Stark, Withdrawals, Depreciation expense-Buildings, Supplies). Therefore, the adjusted trial balance cannot be fully completed without additional information. The totals provided are based on the available data.