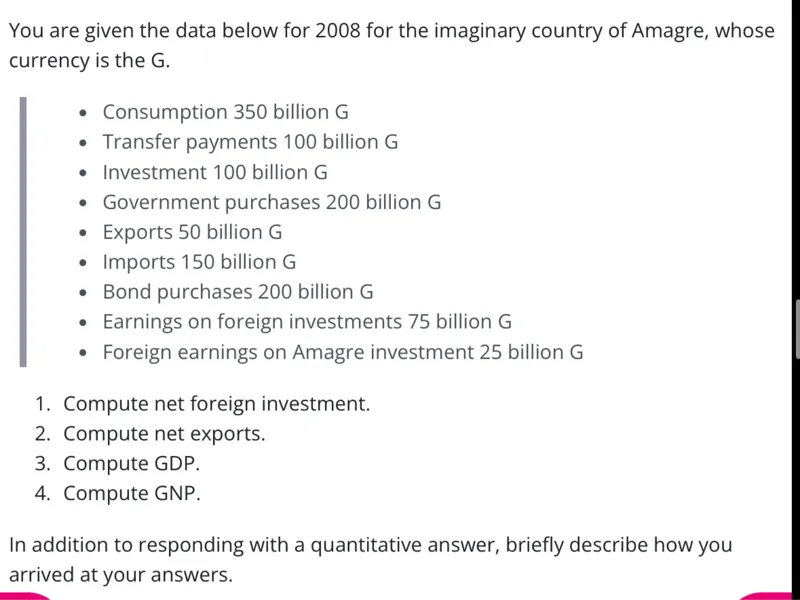

Questions: You are given the data below for 2008 for the imaginary country of Amagre, whose currency is the G. - Consumption 350 billion G - Transfer payments 100 billion G - Investment 100 billion G - Government purchases 200 billion G - Exports 50 billion G - Imports 150 billion G - Bond purchases 200 billion G - Earnings on foreign investments 75 billion G - Foreign earnings on Amagre investment 25 billion G 1. Compute net foreign investment. 2. Compute net exports. 3. Compute GDP. 4. Compute GNP. In addition to responding with a quantitative answer, briefly describe how you arrived at your answers.

Transcript text: You are given the data below for 2008 for the imaginary country of Amagre, whose currency is the G.

- Consumption 350 billion G

- Transfer payments 100 billion G

- Investment 100 billion G

- Government purchases 200 billion G

- Exports 50 billion G

- Imports 150 billion G

- Bond purchases 200 billion G

- Earnings on foreign investments 75 billion G

- Foreign earnings on Amagre investment 25 billion G

1. Compute net foreign investment.

2. Compute net exports.

3. Compute GDP.

4. Compute GNP.

In addition to responding with a quantitative answer, briefly describe how you arrived at your answers.