Questions: Exercise 5-26 (Algorithmic) (LO. 1, 2) Jarrod receives a scholarship of 22,600 from East State University to be used to pursue a bachelor's degree. He spends 13,560 on tuition, 1,130 on books and supplies, 4,520 for room and board, and 3,390 for personal expenses. How much may Jarrod exclude from his gross income?

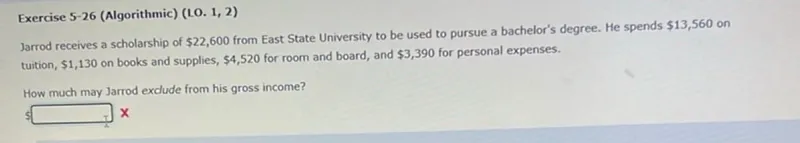

Transcript text: Exercise 5-26 (Algorithmic) (LO. 1, 2)

Jarrod receives a scholarship of $\$ 22,600$ from East State University to be used to pursue a bachelor's degree. He spends $\$ 13,560$ on tuition, $\$ 1,130$ on books and supplies, $\$ 4,520$ for room and board, and $\$ 3,390$ for personal expenses.

How much may Jarrod exclude from his gross income?

$\$$ $\square$