To prepare the required financial statements, we need to follow the standard formats for an income statement and a statement of stockholders' equity. However, the problem does not provide specific revenue or expense figures, so we will focus on the structure and the information given.

An income statement typically includes revenues, expenses, and net income. Since the problem does not provide specific revenue or expense amounts, we will outline the structure:

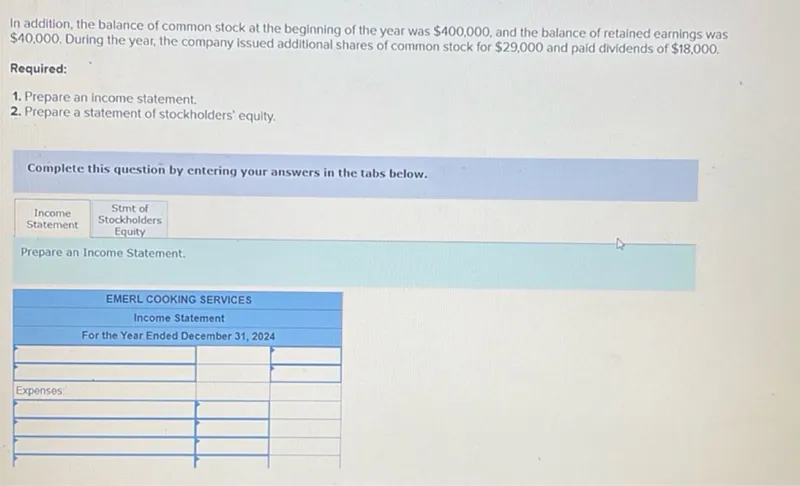

EMERL COOKING SERVICES

Income Statement

For the Year Ended December 31, 2024

Revenues:

- (List any revenue sources if provided)

Expenses:

- (List any expense categories if provided)

Net Income:

- (Calculate as Revenues - Expenses if figures are available)

The statement of stockholders' equity shows changes in equity accounts, including common stock and retained earnings. Based on the information provided:

EMERL COOKING SERVICES

Statement of Stockholders' Equity

For the Year Ended December 31, 2024

| Description | Common Stock | Retained Earnings | Total Equity |

|------------------------|--------------|-------------------|--------------|

| Beginning Balance | $400,000 | $40,000 | $440,000 |

| Issuance of Common Stock| $29,000 | | $29,000 |

| Net Income | | (Assume X) | (Assume X) |

| Dividends | | ($18,000) | ($18,000) |

| Ending Balance | $429,000 | (Assume Y) | (Assume Z) |

Note:

- "Assume X" represents the net income for the year, which is not provided.

- "Assume Y" is the ending balance of retained earnings, calculated as $40,000 + X - $18,000.

- "Assume Z" is the total ending equity, calculated as $429,000 + Y.

Without specific revenue and expense figures, the income statement cannot be completed. The statement of stockholders' equity is prepared based on the given changes in common stock and retained earnings, with placeholders for net income and ending balances.