Questions: State Gasoline Taxes A random sample of state gasoline taxes (in cents) is shown here for 8 states. Round sample statistics and final answers to at least two decimal places. 32.1, 33.3, 50, 43, 44.9, 33.7, 62.8, 49.8 Use the data to estimate the true population mean gasoline tax with 80% confidence. Assume the variable is normally distributed. <μ<

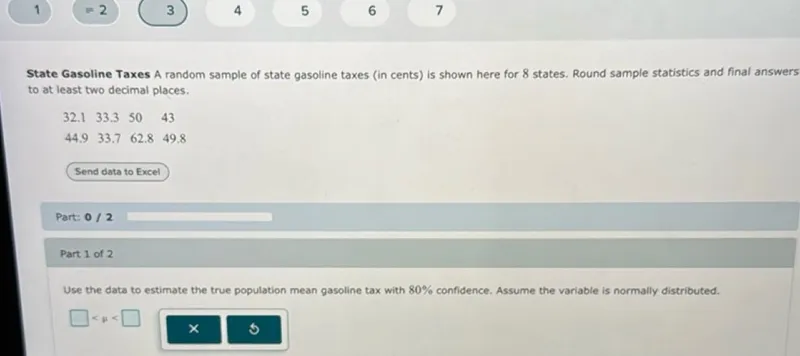

Transcript text: State Gasoline Taxes A random sample of state gasoline taxes (in cents) is shown here for 8 states. Round sample statistics and final answers to at least two decimal places.

$\begin{array}{llll}32.1 & 33.3 & 50 & 43\end{array}$

$\begin{array}{llll}44.9 & 33.7 & 62.8 & 49.8\end{array}$

Use the data to estimate the true population mean gasoline tax with $80 \%$ confidence. Assume the variable is normally distributed.

$\square$ $<\mu<$ $\square$