Questions: QUESTION FOUR a. What is reconstruction and why would a firm want to reconstruct its capital structure? (4 Marks) b. Machambire-Kitundu Ltd (MKL) decided to reconstruct its financial structure. The following scheme of reconstruction was proposed. i. To reduce each share to TZS 6. ii. To write off debentures by 20% iii. To request the banker to write off interest on bank loan. iv. To reduce creditors by TZS 18,000 Information extracted from the statement of financial position of MKL included: a) 10,000 Equity shares of TZS 10 each fully paid. b) 20,000 equity shares of TZS 10 each TZS 8 paid. c) Debentures TZS 120,000, d) Bank loan TZS 90,000 (including interest of TZS 5,400); e) Creditors TZS 80,000. The retained earning account had a debit balance of TZS 110,400; preliminary expenses TZS 15,000; discount on shares debentures TZS 2,000. Required: Provide necessary entries and show the capital reduction account. (8.5 Marks)

Transcript text: QUESTION FOUR

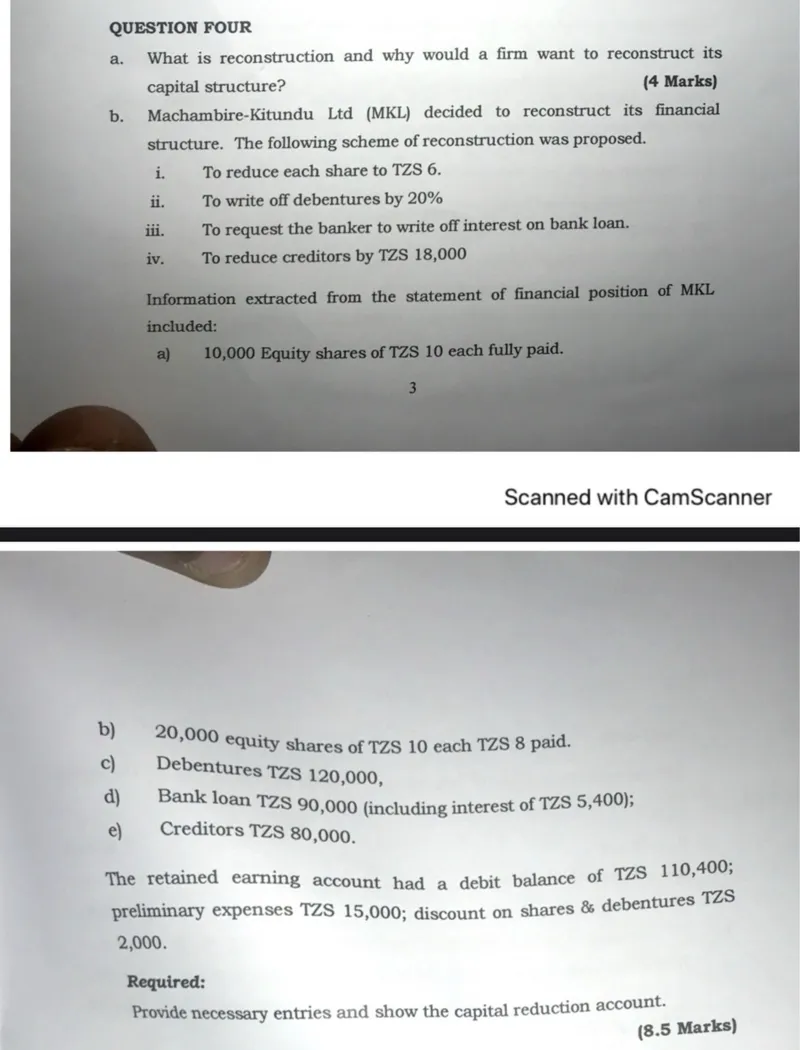

a. What is reconstruction and why would a firm want to reconstruct its capital structure?

(4 Marks)

b. Machambire-Kitundu Ltd (MKL) decided to reconstruct its financial structure. The following scheme of reconstruction was proposed.

i. To reduce each share to TZS 6.

ii. To write off debentures by $20 \%$

iii. To request the banker to write off interest on bank loan.

iv. To reduce creditors by TZS 18,000

Information extracted from the statement of financial position of MKL included:

a) 10,000 Equity shares of TZS 10 each fully paid.

3

Scanned with CamScanner

b) 20,000 equity shares of TZS 10 each TZS 8 paid.

c) Debentures TZS 120,000,

d) Bank loan TZS 90,000 (including interest of TZS 5,400);

e) Creditors TZS 80,000.

The retained earning account had a debit balance of TZS 110,400; preliminary expenses TZS 15,000 ; discount on shares $\&$ debentures TZS 2,000.

Required:

Provide necessary entries and show the capital reduction account.

(8.5 Marks)