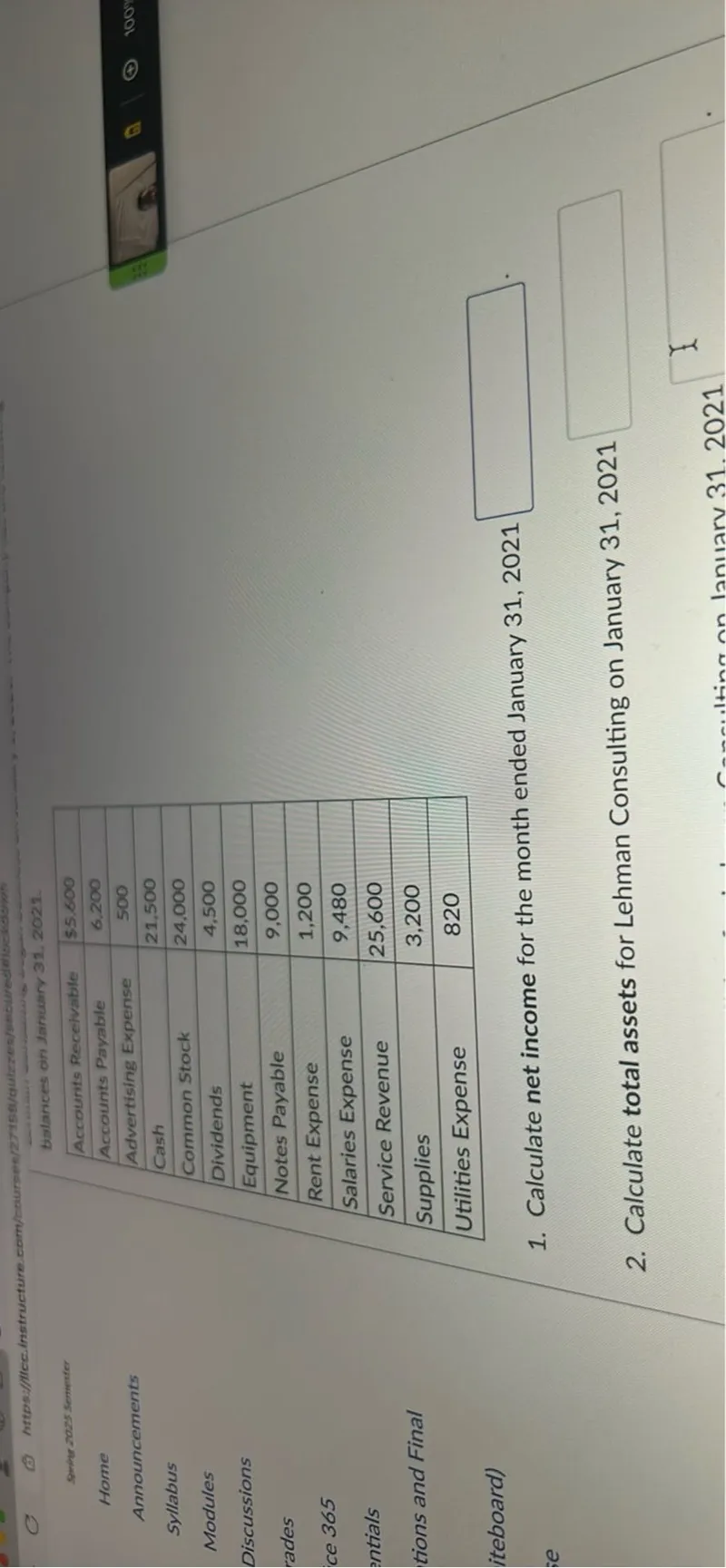

Questions: Accounts Receivable: 5,600 Accounts Payable: 6,200 Advertising Expense: 500 Cash: 21,500 Common Stock: 24,000 Dividends: 4,500 Equipment: 18,000 Notes Payable: 9,000 Rent Expense: 1,200 Salaries Expense: 9,480 Service Revenue: 25,600 Supplies: 820 Utilities Expense: 1. Calculate net income for the month ended January 31, 2021 2. Calculate total assets for Lehman Consulting on January 31, 2021

Transcript text: Accounts Receivable & $5,600$ \\

Accounts Payable & 6,200 \\

Advertising Expense & 500 \\

Cash & 21,500 \\

Common Stock & 24,000 \\

Dividends & 4,500 \\

Equipment & 18,000 \\

Notes Payable & 9,000 \\

Rent Expense & 1,200 \\

Salaries Expense & 9,480 \\

Service Revenue & 25,600 \\

Supplies & 820 \\

Utilities Expense & \\

1. Calculate net income for the month ended January 31, 2021 $\square$

2. Calculate total assets for Lehman Consulting on January 31, 2021 $\square$