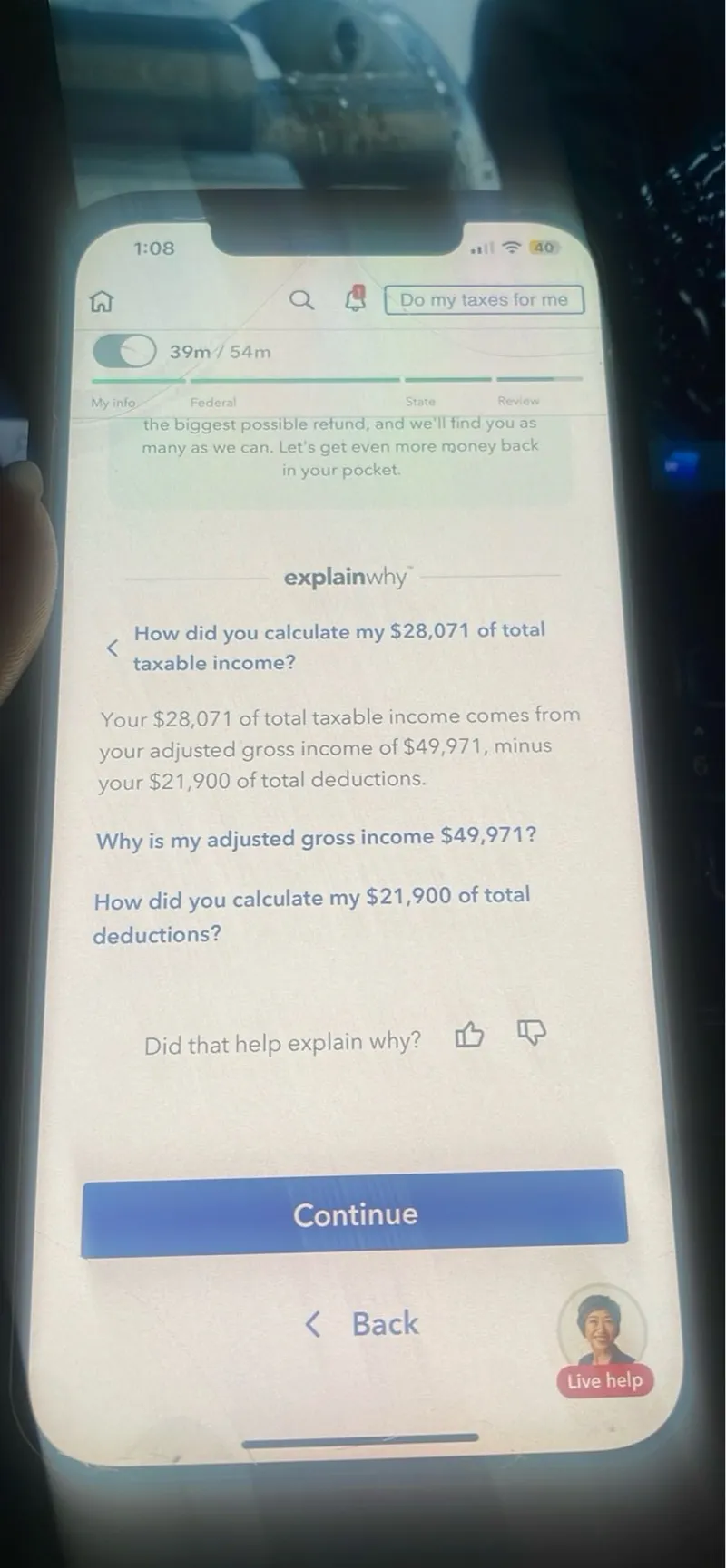

Questions: How did you calculate my 28,071 of total taxable income? Your 28,071 of total taxable income comes from your adjusted gross income of 49,971, minus your 21,900 of total deductions. Why is my adjusted gross income 49,971? How did you calculate my 21,900 of total deductions?

Transcript text: How did you calculate my $\$ 28,071$ of total taxable income?

Your $\$ 28,071$ of total taxable income comes from your adjusted gross income of $\$ 49,971$, minus your \$21,900 of total deductions.

Why is my adjusted gross income \$49,971?

How did you calculate my $\$ 21,900$ of total deductions?