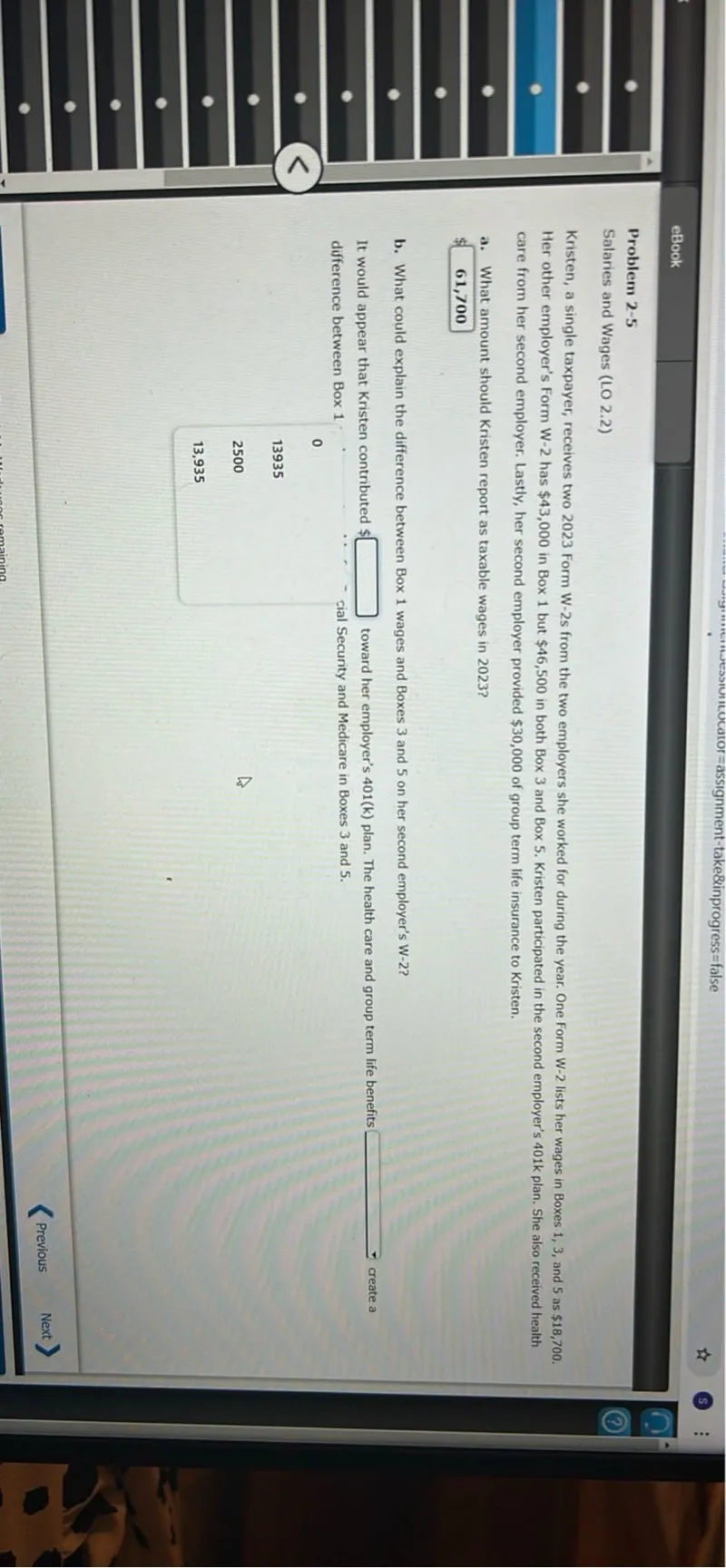

Questions: Problem 2-5 Salaries and Wages (LO 2.2) Kristen, a single taxpayer, receives two 2023 Form W-2s from the two employers she worked for during the year. One Form W-2 lists her wages in Boxes 1,3 , and 5 as 18,700. Her other employer's Form W-2 has 43,000 in Box 1 but 46,500 in both Box 3 and Box 5. Kristen participated in the second employer's 401 k plan. She also received health care from her second employer. Lastly, her second employer provided 30,000 of group term life insurance to Kristen. a. What amount should Kristen report as taxable wages in 2023? 61,700 b. What could explain the difference between Box 1 wages and Boxes 3 and 5 on her second employer's W-2?

Transcript text: Problem 2-5

Salaries and Wages (LO 2.2)

Kristen, a single taxpayer, receives two 2023 Form W-2s from the two employers she worked for during the year. One Form W-2 lists her wages in Boxes 1,3 , and 5 as $\$ 18,700$. Her other employer's Form W-2 has $\$ 43,000$ in Box 1 but $\$ 46,500$ in both Box 3 and Box 5 . Kristen participated in the second employer's 401 k plan. She also received health care from her second employer. Lastly, her second employer provided $\$ 30,000$ of group term life insurance to Kristen.

a. What amount should Kristen report as taxable wages in 2023?

\$ 61,700

b. What could explain the difference between Box 1 wages and Boxes 3 and 5 on her second employer's W-2?