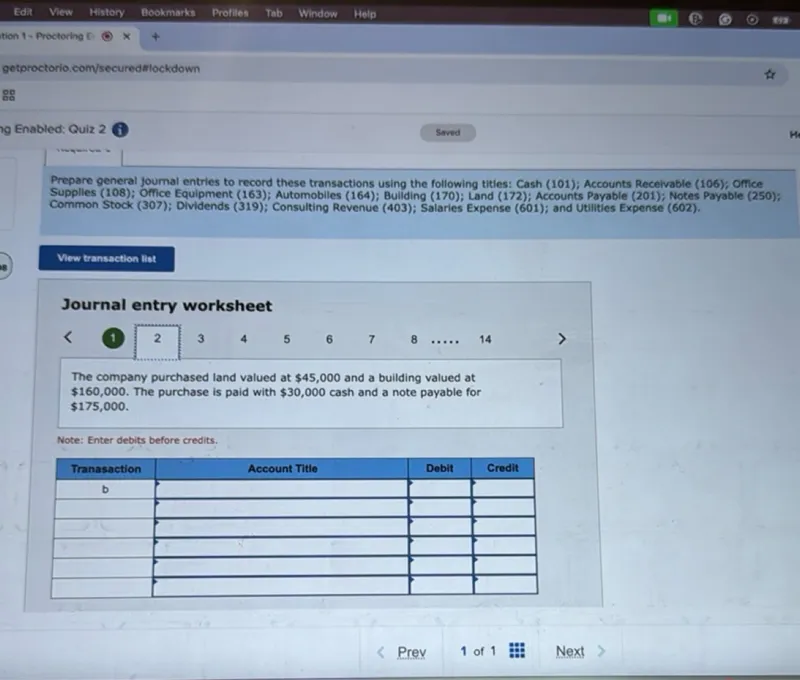

Questions: Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); Common Stock (307); Dividends (319); Consulting Revenue (403); Salaries Expense (601); and Utilities Expense (602). The company purchased land valued at 45,000 and a building valued at 160,000. The purchase is paid with 30,000 cash and a note payable for 175,000. Note: Enter debits before credits.

Transcript text: Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); Common Stock (307); Dividends (319); Consulting Revenue (403); Salaries Expense (601); and Utilities Expense (602).

The company purchased land valued at $45,000 and a building valued at $160,000. The purchase is paid with $30,000 cash and a note payable for $175,000.

Note: Enter debits before credits.