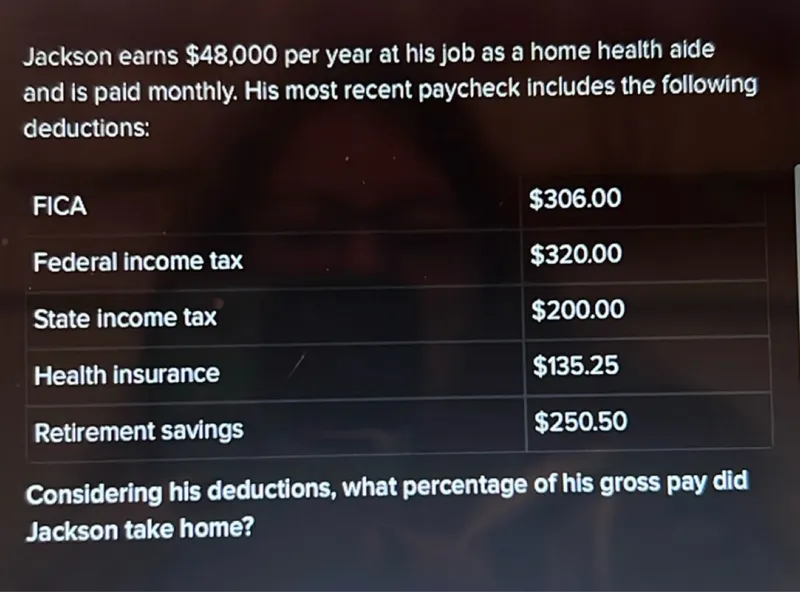

Questions: Jackson earns 48,000 per year at his job as a home health aide and is paid monthly. His most recent paycheck includes the following deductions: FICA 306.00 Federal income tax 320.00 State income tax 200.00 Health insurance 135.25 Retirement savings 250.50 Considering his deductions, what percentage of his gross pay did Jackson take home?

Transcript text: Jackson earns $\$ 48,000$ per year at his job as a home health aide and is paid monthly. His most recent paycheck includes the following deductions:

\begin{tabular}{|l|l|}

\hline FICA & $\$ 306.00$ \\

\hline Federal income tax & $\$ 320.00$ \\

\hline State income tax & $\$ 200.00$ \\

\hline Health insurance & $\$ 135.25$ \\

\hline Retirement savings & $\$ 250.50$ \\

\hline

\end{tabular}

Considering his deductions, what percentage of his gross pay did Jackson take home?